A recent Semiconductor Intelligence Newsletter reviewed the present lineup of analog semiconductor companies. The newsletter said that one of the current changes involved Renesas Electronics’ announcement of an agreement to acquire Intersil Corp. for US$3.22 billion. This follows July's announcement that Analog Devices Inc. (ADI) will acquire Linear Technology Corp. (LTC) for $14.8 billion. These deals are certain to cause a shakeup in the analog IC market. According to IC Insights’ ranking of analog IC suppliers for 2015, ADI, LTC, and Renesas stood at number four, eight, and 10, respectively.

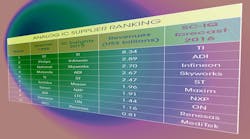

Comparing 2015 analog rankings with those of 20 years ago, from 1995, reveals some interesting changes. The table shows Gartner’s (then known as Dataquest) 1995 analog rankings, IC Insights’ rankings for 2015, and the Semiconductor Intelligence (SC-IQ) forecast of 2016 rankings.

Only three names from the 1995 list remain on the 2015 list: STMicroelectronics (ST), Texas Instruments (TI), and ADI. However, several of the analog businesses from 1995 are represented in 2015 under different names through various spinoffs, acquisitions, and mergers.

For example, Philips, number two in 1995, spun off its semiconductor business as NXP Semiconductors in 2006. NXP is number seven on the 2015 list. National Semiconductor, number three in 1995 (at that time, National included Fairchild Semiconductor, which was spun off in 1997), was acquired by TI in 2011, solidifying TI's number one ranking. TI further bolstered its analog position with acquisitions of Silicon Systems in 1996, Unitrode and Power Trends in 1999, and Burr-Brown in 2000.

Motorola (number four in 1995) divested its semiconductor businesses as ON Semiconductor in 1999 and Freescale Semiconductor in 2003. In 2015, ON Semiconductor agreed to acquire Fairchild, with completion expected within a few months (ON's number nine 2015 ranking doesn’t include Fairchild). In another move, NXP acquired Freescale in December 2015 (NXP’s 2015 number seven ranking includes Freescale).

Siemens, number nine in 1995, spun off its semiconductor business as Infineon Technologies in 1999. In 2015, Infineon rose to number two on the chart. Some of Infineon’s growth was due to the acquisition of International Rectifier in January 2015.

NEC (number 10 in 1995) combined its semiconductor business, NEC Electronics, with Renesas Technology in 2010 to form Renesas Electronics. Renesas Technology was formed in 2003 as a joint venture of the semiconductor business of Mitsubishi (number 13 in the 1995 analog rankings) and Hitachi (number 16).

Two companies from the 1995 rankings, Toshiba and Sanyo, are both still in the analog business, but as can be seen, dropped out of the top 10.

Thus, only three companies in the 2015 ranking don’t have ties to companies in the 1995 ranking. Skyworks Solutions was formed in 2002 with the merger of Alpha Industries and Conexant's wireless division. Maxim Integrated wasn’t even in the top 20 in the 1995 analog rankings, but moved up to number six in 2015 by raking in over 10 times the revenue of 1995. Much of Maxim's growth was driven by acquisitions, including Dallas Semiconductor and Volterra, and product lines from Vitesse and Zilog. LTC came in at number 18 in 1995, and moved up to the eighth spot in 2015. LTC's growth was primarily organic, with few acquisitions.

Maxim has been mentioned as both a potential acquisition target and a potential buyer. Bloomberg reported in January 2016 that TI and ADI each investigated an acquisition of Maxim, but both decided the price was too high. And it was reported in August that Maxim was in the bidding for Intersil before Renesas closed the deal.

Predicting 2016’s Rankings

What will the analog rankings look like when 2016 is over? TI will certainly remain number one with over $8 billion in analog revenue. ADI will move to the number two slot, with over $4 billion in revenue that includes LTC’s earnings. The ADI and LTC merger will not be completed until 2017, but their revenues are combined in 2016 for comparison.

Infineon and Skyworks should be three and four, but there’s a chance Skyworks could pass Infineon. Maxim and NXP will likely remain at six and seven. ON will add over $300 million in analog revenue with the Fairchild acquisition, and move up from number nine to number eight. However, ON won’t officially pass anyone on the list, just move up one with elimination of LTC. Renesas will add over $500 million in analog revenue with the Intersil acquisition and move up one spot to number nine (Renesas and Intersil are combined for comparison in 2016, even though the deal will not be complete until 2017).

The ADI and LTC combination will open up a spot in the top 10 in 2016, which should go to MediaTek. The company added about $400 million in analog revenue with the acquisition of Richtek Technology in October 2015.

Disappearing Pioneers

The proposed acquisition of Intersil by Renesas will lead to the further disappearance of two pioneers in the semiconductor industry. Intersil was formed in 1999 when Harris Corp. spun off its semiconductor business. Harris had previously purchased the General Electric (GE) semiconductor business in 1988. The GE semiconductor business included RCA Solid State, which GE purchased from RCA in 1986. Harris began its semiconductor operation in 1967 with the purchase of Radiation Inc.

Also in 1967, the original Intersil was founded by Jean Hoerni, one of the founders of Fairchild and inventor of the planar process. GE bought Intersil in 1981. The Intersil name was revived with the 1999 spinoff from Harris.

GE and RCA were early leaders in the semiconductor market. GE was one of the original licensees of the AT&T transistor patent and RCA was an early licensee. The two companies also did significant semiconductor research on their own. The history of early GE and RCA research is detailed in the excellent “Transistor History” website created by Mark P. D. Burgess.

In addition, GE and RCA were leaders in consumer electronics and primarily used many of their semiconductors internally, but they also sold on the merchant market. GE was a major supplier of discrete semiconductors in the 1960s, while RCA was a top 10 merchant semiconductor supplier in the mid-1970s.

Now, after the Intersil acquisition, Renesas Electronics will contain the remnants of five semiconductor companies that began semiconductor research in the 1940s and 1950s: GE, RCA, NEC, Hitachi, and Mitsubishi.

Semiconductor Intelligence LLC is a consulting firm providing market analysis, market insights and company analysis for anyone involved in the semiconductor industry - manufacturers, designers, foundries, suppliers, users or investors. Semiconductor Intelligence LLC publishes a newsletter that analyzes all aspects of the semiconductor industry.

IC Insights, Inc. is a semiconductor market research company that offers complete analysis of the integrated circuit (IC), optoelectronic, sensor/actuator, and discrete semiconductor markets with coverage including current business, economic, and technology trends, top supplier rankings, capital spending and wafer capacity trends, the impact of new semiconductor products on the market, and other relevant semiconductor industry information.